What happens if I withdraw from some or all of my classes?

If your invoice is paid using financial aid, and it is necessary to officially withdraw from all classes, please see the "Refund/Repayment Policy Cancelation" below.

If you withdraw from some but not all of your courses, your aid could be affected as follows:

Academic Considerations

The first and most important thing to consider before dropping classes is how it will affect you academically. You should meet with your advisor to consider all the implications of dropping a course.

Financial Implications (Student Accounts)

If you are receiving financial aid, you will be reviewed for Standards of Satisfactory Academic Progress (SAP). If you drop below half time, you can no longer work as a Federal Work-Study student. In addition, you may be subject to the Refund/Repayment Policy.

Scholarship Concerns

Scholarships have credit hour requirements. If you drop below the required hours, the refund is repaid to the scholarship.

Federal Pell Grant

The Pell Grant will be adjusted for any change in enrollment that occurs on or prior to the 15th day of the semester. Pell will also be adjusted for any class withdrawn from that has not yet begun. Withdrawing from a class in the fall may keep you from academically progressing, which could make you ineligible for a Pell Grant in the spring.

Ohio College Opportunity Grant (OCOG)

OCOG will be adjusted for any change in enrollment that occurs on or prior to the 15th day of the semester. If credit hours are reduced after the 15th, day and the university is in a refund period, the grant will be pro-rated.

Additional Loan Concerns

Dropping classes may have an impact on your student loans! Student loans, including Nursing Student Loan, Federal Direct Subsidized Loan and Federal Direct Unsubsidized Loan, will stay in deferment status as long you continue to attend school at least half time. If you drop below half-time for longer than six months (Federal Direct) or nine months (Nursing), the repayment period will start. In addition, student loans currently being disbursed may be cancelled and returned to the lender if you drop below half time. For example, if your loan is for two semesters, the second semester portion may be cancelled, reduced, or returned. (Half-time enrollment is six credits for undergraduate students and five credits for graduate/professional students.)

Refund Repayment Policy Calculation

Federal Student Aid (FSA), also known as Title IV funding is awarded under the assumption that a student will complete course(s) for the entire semester and/or payment periods for which the funds are awarded. When a student ceases attendance, officially and/or unofficially, in a course, regardless of the reason, the student may no longer be eligible for the full amount of Title IV funds originally awarded.

The return of funds to the federal government is based on the premise that financial aid is earned in proportion to the length of time during which the student attended. A pro-rated schedule determines the amount of federal aid a student has earned while attending. This refund policy is used to determine the amount of federal student aid that must be returned (refunded) to the appropriate aid programs and should not be confused with the published University refund policy.

If the amount disbursed to the student is greater than the amount the student earned, the unearned funds must be returned to the federal program(s). If the amount disbursed to the student is less than the amount the student earned, and for which the student is otherwise eligible, he or she is eligible to receive a post-withdrawal disbursement of the earned aid that was not received.

Earned Versus Unearned Federal Student Aid

If a student officially or unofficially withdraws, ceases attendance, or is administratively withdrawn from The University of Akron, federal regulations require The University of Akron to calculate the amount of Federal Title IV funds earned during the term from which the student withdrew.

A student earns their federal aid on a pro-rated basis, does not earned 100% until they attend past the 60% point of the period/semester.

The percent earned is equal to the number of calendar days completed up to the withdrawal (officially or unofficially) date divided by the total number of calendar days in the semester/payment period. Breaks of 5 days or longer are not included in the count of total days in the payment period (i.e., student withdraws on the 5th day of the semester which has 110 days in its period, 5/110 = 5 percent earned).

Earned Percent = Number of Days Completed ÷ Total Days in Payment Period

Unearned Percent = 100% - Earned Percent

The repayment calculation is performed utilizing the federal government’s Total Withdraw Repayment Worksheet.

Student Notification of Repayment

The student and the school are both responsible for returning unearned federal financial aid to the federal government. Subtracting earned aid from aid what was awarded and disbursed gives you the amount of unearned aid that must be returned.

If the institution is required to return unearned loan funds based on the calculation the funds will be returned to the Department of Education which will reduce the loan amount borrowed by the student to the Department of Education. If a portion of unearned loan funds is in the student calculation, they will repay this amount under the normal terms of their loan agreement as outlined in the Master Promissory note. The institution will return any grant funds to the Department of Education as designated in the calculation under the school’s calculation. If the student’s calculation determines grant funds are returned, The University of Akron chooses to return the portion of students grant to the Department of Education if grant owed is more than $50 to prevent a “C” code for the student. A “C” code flag would prevent the student from receiving future federal aid until the funds are paid by the student to the Department of Education. The University of Akron reduces the grant and sends back the student portion to prevent this from happening. The student may be billed by The University of Akron for any account balance created from the withdraw due to unearned funds no longer covering tuition charges and/or funds received in an excess aid check. The student will receive letter once the calculation is completed within 30 days of the withdraw. A school must always return any unearned Title IV funds it is responsible for returning within 45 days of the date the school determined the student withdrew.

Under the refund/repayment policy, the programs are reimbursed in the following order:

- Federal Direct Unsubsidized Loan

- Federal Direct Subsidized Loan

- PLUS Loan

- Grad PLUS Loan

- Federal Pell Grant

- Iraq and Afghanistan Service Grant

- Federal Supplemental Educational Opportunity Grant

- TEACH Grant

State aid will be refunded based on the published University refund policy.

Withdrawal dates are determined in one of the following ways, depending on the situation:

- The date the withdrawal form is processed by the Office of the Registrar.

- The date the student is officially dismissed from the College.

- The last date of documented academic attendance.

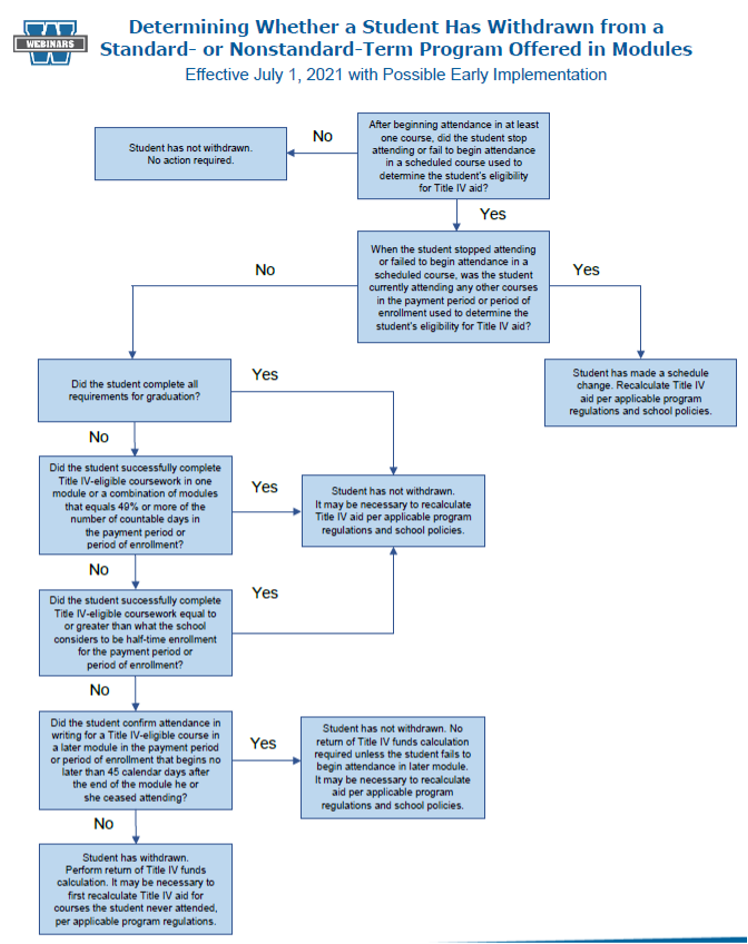

- For a student in a non-term or nonstandard term program, the withdraw is based on Federal Determination Chart (below) and did not provide written confirmation to attend class no later than 45 calendar days after the end of the module/mini course the student ceased attending in the same payment period.

- In case of unofficial withdrawals or persons receiving all "non-passing" grades, it is the last date of documented academic attendance or mid-point of the period of enrollment or.

A post-withdrawal disbursement

- Post-Withdrawal Disbursement of Federal Grant Funds

The University of Akron will automatically credit the student’s account with a late disbursement of Pell Grant and FSEOG funds for current institutional charges (tuition, fees, room, and board). Excess funds will be refunded to the student. The post-withdrawal disbursement will be made within 45 days of the date the institution determined the student withdrew. - Post-Withdrawal Disbursement of Federal Loan Funds

Post-withdrawals happen when the loan has been originated and guaranteed but did not arrive at the school prior to withdraw.

If a post-withdrawal disbursement includes federal loan funds, The University of Akron must obtain the students, or parent if a PLUS loan, permission before it can be disbursed. The borrower will be notified within 30 days of the date of determination of withdrawal of the opportunity to accept all or a part of the post-withdrawal disbursement. The student or parent has 14 days from the date of notification to respond. In the event the Office of Student Financial Aid does not receive a response from the student within the time limitation set, the post-withdrawal is forfeited. The University of Akron will disburse the loan funds within 180 days of the date of determination of the student's withdrawal date. Loan funds will be applied towards the outstanding semester charges on the student's account and may pay up to the amount of the allowable charges. Any remainder will be paid directly to the student or parent.

Treatment of Title IV credit balance when a student withdraws

According to Federal policy 34 CFR 668.164, The University of Akron disburses Title IV program funds to a student's account and the total amount of these funds exceeds the amount of institutional charges, The University of Akron must refund the resulting credit balance to the student or parent as soon as possible but-

- No later than 14 days after the balance occurred if the credit balance occurred after the first day of class of a payment period: or

- No later than 14 days after the first day of class of a payment period if the credit balance occurred on or before the first day of class of that payment period.

When a student with Title IV program funds withdrawals, and has a credit balance on their student account after applying the institutional tuition credit policy and processing a Return to Title IV (R2T4) calculation, The University of Akron will refund the credit balance to the student or parent as soon as possible but no later than 14 days from the date the school performs the R2T4 calculation.