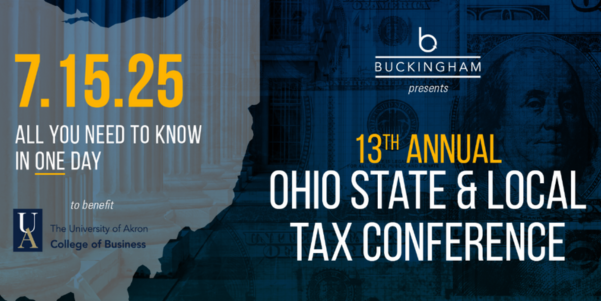

Tuesday, July 15, 2025

7:30 a.m. – 4:00 p.m.

$325 per person

Earn 8 hours of Ohio CPE credit; 6.75 hours CLE credit (approval pending)

This one-day session will cover the latest information relative to Ohio sales/use tax, commercial activity tax, personal income tax/pass-through entity tax and multistate tax issues ...and more!

Location: Holiday Inn (6001 Rockside Road, Independence, OH, 44131)

Agenda

7:30 - 7:55am

Registration and Continental Breakfast

7:55am

Welcome and Introduction

Jules Jones | The University of Akron College of Business

Steve Dimengo | Managing Partner, Buckingham, Doolittle & Burroughs, LLC

Jules Jones | The University of Akron College of Business

Steve Dimengo | Managing Partner, Buckingham, Doolittle & Burroughs, LLC

8:00 - 8:50am

Multistate Tax

Jimmy Papotto | Manager, State & Local Tax, PwC

Kristen Neely | Director, State & Local Tax, PwC

Jimmy Papotto | Manager, State & Local Tax, PwC

Kristen Neely | Director, State & Local Tax, PwC

8:50 - 9:40am

Ohio Sales/Use Tax

Steve Dimengo | Managing Partner, Buckingham, Doolittle & Burroughs, LLC

Youssef Hanna | Attorney, Office of Chief Counsel, OH Dept of Taxation

Laura Stanley | Assistant Chief Counsel, OH Dept of Taxation

Steve Dimengo | Managing Partner, Buckingham, Doolittle & Burroughs, LLC

Youssef Hanna | Attorney, Office of Chief Counsel, OH Dept of Taxation

Laura Stanley | Assistant Chief Counsel, OH Dept of Taxation

9:40 - 9:50am

Networking Break

9:50 - 10:40am

Commercial Activity Tax

Richard Fry | Partner, Buckingham, Doolittle & Burroughs, LLC

Kyra Horvath | Division Counsel, OH Dept of Taxation

Richard Fry | Partner, Buckingham, Doolittle & Burroughs, LLC

Kyra Horvath | Division Counsel, OH Dept of Taxation

10:40 - 11:30am

Ohio Pass-Through Entity and Personal Income Tax Updates

Nathan Fulmer | Associate, Buckingham, Doolittle & Burroughs, LLC

Nicholas Mucci | Attorney, Office of Chief Counsel, OH Dept of Taxation

Nathan Fulmer | Associate, Buckingham, Doolittle & Burroughs, LLC

Nicholas Mucci | Attorney, Office of Chief Counsel, OH Dept of Taxation

11:30 - 12:00pm

Lunch buffet & Networking break

12:00 - 1:00pm

Luncheon Keynote Speaker – Economic & Market Update: World in Transition: Economic & Market Overview

Michael McKeown | CFA,CPA, Market Strategist, SVP, Aurum Team at Wealth Enhancement

Michael McKeown | CFA,CPA, Market Strategist, SVP, Aurum Team at Wealth Enhancement

1:00 - 1:10pm

Networking Break

1:10 - 2:00pm

Be Careful — Be It Real or Personal? Classification of Ohio Based Property and the Consequences Thereof

Steven Dimengo | Managing Partner, Buckingham, Doolittle & Burroughs, LLC

Nathan Fulmer | Associate, Buckingham, Doolittle & Burroughs, LLC

Youssef Hanna | Attorney, Office of Chief Counsel, OH Dept of Taxation

Laura Stanley | Assistant Chief Counsel, OH Dept of Taxation

Steven Dimengo | Managing Partner, Buckingham, Doolittle & Burroughs, LLC

Nathan Fulmer | Associate, Buckingham, Doolittle & Burroughs, LLC

Youssef Hanna | Attorney, Office of Chief Counsel, OH Dept of Taxation

Laura Stanley | Assistant Chief Counsel, OH Dept of Taxation

2:00 - 2:50pm

Multistate Tax Sourcing and Impact on M&A Transactions

Richard Fry | Partner, Buckingham, Doolittle & Burroughs, LLC

John Burgett | Senior Manager, State & Local Tax, Bober Markey Fedorovich

David Harris | Senior Manager, Meaden & Moore

Richard Fry | Partner, Buckingham, Doolittle & Burroughs, LLC

John Burgett | Senior Manager, State & Local Tax, Bober Markey Fedorovich

David Harris | Senior Manager, Meaden & Moore

2:50 - 3:00pm

Networking Break

3:00 - 3:50pm

Will there be a SALT secession from federal tax changes? This and other SALT developments and trends.

Fred Nicely | Senior Tax Counsel, COST

Nikki Dobay | Shareholder, GreenbergTraurig

Fred Nicely | Senior Tax Counsel, COST

Nikki Dobay | Shareholder, GreenbergTraurig

Questions about registration? Contact Jenn Venuto at jvenuto@bdblaw.com

The State & Local Tax Conference is an outreach activity of the University of Akron's Master of Taxation program. Learn more here.